Decision support for your investment

Judge for yourself whether the company has a chance and an investment is interesting for you.

Rely on your judgment.

Investing in a young company involves not only opportunities, but also risks. When evaluating a project, you should rely on your own judgment and get an understanding of how the company wants to generate profits in the future and whether this is realistic.

Evaluate with a system.

To support your assessment, the necessary information is available on our platform, well structured and clearly arranged. The uniform presentation of the information also gives you the opportunity to directly compare the projects and draw conclusions.

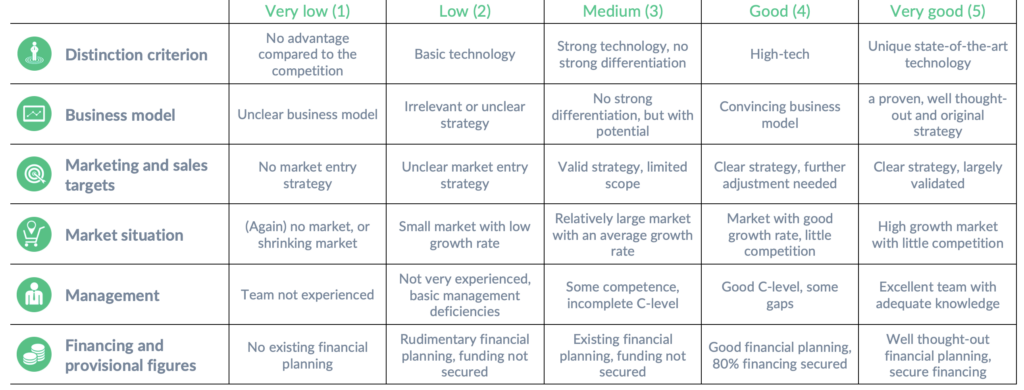

Evaluation criteria for your investment

As a guideline for the evaluation of the respective business plan, different perspectives of the company are presented to you. The following 6 criteria could serve as a guide for your assessment.

Unique selling proposition

See moreOne key criterion to consider, among others, is the unique selling proposition.

Think about what makes the product or service unique. The following questions can help you to do this:

- What is the quality of the technology or innovation?

- Is there already a patent for this, or how imitable is this?

- Does the product or service offer the company a relevant advantage over the competition?

- How sustainable is the technology or innovation?

Marketing and sales targets

See moreHere it is important to consider how the company or the product will be introduced to the market.

- Are the target markets clearly defined and the market launch plausibly explained?

- Does the sales planning seem realistic and is it achievable within the specified timeframe?

- Is the market potential realistic?

- Are the target groups clearly defined and distinguishable from each other?

- Are the planned market launch measures on target?

- Does the company have an existing network (suppliers, producers, distributors, cooperation partners, etc.)?

- Is the team well enough positioned and are there sufficient resources for the rollout?

Management

See moreIn order to implement the described business model and make the project successful, it ultimately requires people with the right expertise. For this reason, you should take a close look at the team behind it.

- What qualifications and expertise do the team members bring to the table?

- What did these people do before?

- What positions exist in the company and by whom are they held?

- Can the company attract additional qualified personnel in the future?

- Is the company organization clearly defined and are the key functions properly staffed?

Business model

See moreAnother criterion is the credibility of the business model.

- What is the company's business strategy?

- Does the company have a vision?

- How convincing is the product strategy?

- What does the lead over the competition look like?

- How transparent and plausible is the financial strategy?

Market situation

See moreCompanies usually have a large number of market opportunities that they must first identify, then evaluate and finally compare. To do this, they need values such as market size, market growth or market potential.

You should definitely ask yourself the following questions for your investment decision:

- How big is the market and is the market size plausibly defined?

- How fast will this market grow?

- Is the product on trend?

- What is the competitive situation in these markets?

- Is the market potential large enough to allow additional market participants?

- Are there technical, legal or financial barriers to entry? If so, how high are they?

Financing and planning figures

See moreJust as important as the assessment of the market development, is an evaluation of the financing as well as the plan calculation. For this assessment, it is necessary to know the hypotheses of the founding team in order to be able to estimate the costs of implementation.

- Can the company make a profit if it achieves its planned sales and revenue targets?

- Does the company have sufficient liquidity and thus assets to finance the relevant milestones?

- Are there liabilities in the company that threaten liquidity in the short term?

- Are the steps for possible follow-up funding realistically estimated?

Additional tips for your investment

Get the information you need.

On every project page you will find the "Questions and Answers" section. Ask your questions there directly to the entrepreneurs or share your assessments with other investors.

Read the participation agreement.

On the project pages you will find the participation contract of the company for each project.

Risk notice

The acquisition of an investment involves not inconsiderable risks and can lead to the complete loss of the invested assets. As a general rule, the higher the return or yield, the greater the risk of loss.

Deutsch

Deutsch

Français

Français